Financial inclusion is a vital component of a just and equitable society. It is the process of ensuring that all individuals and communities, regardless of their economic status, have access to essential financial services and resources.

In today’s world, where wealth inequality is a significant challenge, achieving financial inclusion is more critical than ever, particularly for the less privileged segments of society.

- Essential Tips to Learn to Gain Financial Freedom

- Mastering The Heart of Savings For Wealth Creation

- Conclusion on Wealth Building Procedures for the Less Privileged

For the less privileged, navigating the complexities of personal finance and wealth building can be daunting. Often, they face numerous barriers, including limited access to banking services, financial education, and investment opportunities. Without adequate support and resources, breaking the cycle of poverty and achieving financial stability can seem like an insurmountable task.

However, financial inclusion offers a glimmer of hope. Providing the necessary tools, education, and support, empowers individuals from marginalized communities to take control of their financial futures and build wealth for themselves and their families.

Knowledge Acquisition is a Must-have Asset For Wealth Creation For the Less Privileged

According to Forbes Advisor, Investing is the act of buying assets that appreciate with time and provide income payments or capital gains.

In the financial world, investing refers to the purchase of securities, real estate, and other valuable items to achieve capital gains or income. This definition highlights the idea that investing is a strategic decision aimed at increasing wealth over time.

Investment refers to the act or process of setting aside money to obtain better returns. It is an essential step towards building and creating wealth. To succeed in investment, it is crucial to have a strong understanding of what you are investing in.

This means that you must invest in knowledge and avoid risking your money or savings in areas where you have little or no knowledge. Therefore, acquiring knowledge about your area of investment should be the first step in your investment journey.

This is where the Supportive Pillar Foundation comes in to assist anyone looking to gain knowledge in different areas of skill acquisition- for free.

Essential Tips to Learn to Gain Financial Freedom

The wealthiest man in Africa, for several years, once stated that the Dangote Group only ventures into businesses they know about. They acquire knowledge and strive to be the first in that field, not second. Gathering knowledge and understanding helps to create a strong foundation for success before investing.

It is wise to know the way before embarking on a journey and identifying potential pitfalls. Ideally, you can learn from a group of people who have already made such investments and achieved tangible success over the years. Learn from them, compare their different principles, evaluate their challenges, and how they overcame them.

Listen and gain from their wealth of wisdom and experience. Accumulating this knowledge will position you for success in your investing.

A wise person once said that no thief can rob the bank of knowledge. When it comes to investing, money may be lost and time may be wasted, but an investor’s knowledge bank cannot be taken away.

This bank of knowledge can be a valuable resource for an investor to recover from any losses. However, an investor who lacks knowledge may not be able to recover from a negative situation.

Mastering The Heart of Savings For Wealth Creation

Mastering the heart of savings involves discipline, setting clear goals, and prioritizing needs over wants. It’s about consistently putting aside money, no matter how small, and making smart financial decisions to grow your wealth over time.

Here are financial inclusion tips for wealth creation for the less privileged;

- Set clear financial goals: Define what you want to achieve, whether it’s a short-term goal or a long-term dream.

- Create a budget: Track your income and expenses to understand where your money is going and make informed decisions.

- Start small: Begin with manageable savings amounts and gradually increase them over time.

- Automate your savings: Set up automatic transfers from your checking account to your savings or investment accounts.

- Take advantage of employer matching: Contribute to tax-advantaged accounts like 401(k), IRA, or Roth IRA, and maximize employer matching.

- Diversify your investments: Spread your savings across different asset classes, such as stocks, bonds, and real estate, to minimize risk.

- Avoid unnecessary expenses: Cut back on unnecessary spending, and prioritize needs over wants.

- Build an emergency fund: Save 3-6 months’ worth of living expenses for unexpected events or financial downturns.

- Monitor and adjust: Regularly review your savings progress and adjust your strategy as needed.

- Avoid lifestyle inflation: As your income increases, direct excess funds towards savings and investments rather than inflating your lifestyle.

- Develop a long-term perspective: Focus on sustainable wealth growth rather than quick fixes or get-rich-quick schemes.

- Educate yourself: Continuously learn about personal finance, investing, and money management.

- Avoid high-interest debt: Prioritize paying off high-interest loans and credit cards to free up more money for savings.

- Leverage tax-advantaged accounts: Utilize tax-efficient savings vehicles like 529 plans for education expenses or Health Savings Accounts (HSAs) for medical costs.

Conclusion on Wealth Building Procedures for the Less Privileged

Financial inclusion is a powerful tool that can help empower less privileged individuals and promote economic equality. By providing access to financial education through skill acquisition, empowerment initiatives, and investment opportunities, we can help people from marginalized communities build wealth and create a better future for themselves and their families.

However, achieving true financial inclusion requires a concerted effort from governments, financial institutions, and civil society to address systemic barriers and ensure that everyone has an equal opportunity to thrive.

Remember, growing your net worth takes time, discipline, and patience. Start with small steps, and over time, you’ll develop a robust savings habit that will help you achieve your financial goals.

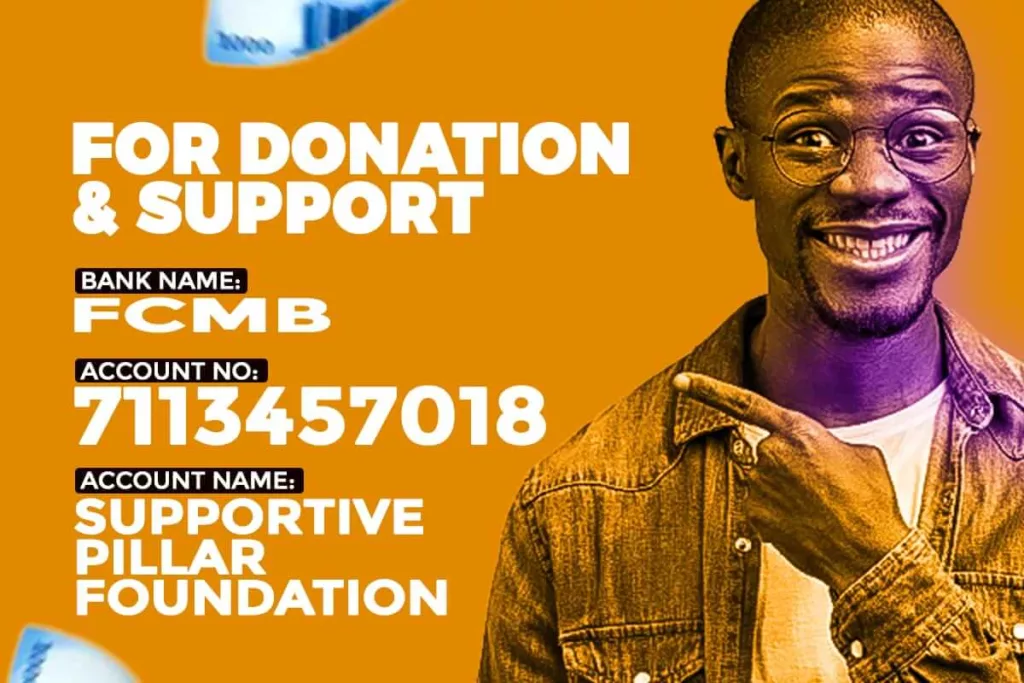

If you are interested in supporting our cause as one of the most effective and diligent charity organizations in Nigeria and Africa, please don’t hesitate to contribute via our donate page or contact us for more information.

The Supportive Pillar Foundation in Nigeria combats hunger and empowers the underprivileged.

Uhmm. Thank you for this beautiful piece. I find it useful.

Glad you found it useful.