A paycheck is the amount of money a person receives regularly, such as monthly or weekly, for their work or for completing a specific task. It symbolizes the reward for work done.

Paychecks are essential for meeting basic needs like food, clothing, and shelter, as well as supporting loved ones and fulfilling immediate obligations. However, financial prosperity goes beyond regular earnings. It involves achieving financial wealth, physical health, and intellectual strength.

It’s about reaching a state where there is no longer a concern about paying bills, providing for loved ones, or meeting daily needs. True financial prosperity shifts the focus to investments, solving societal problems, and creating sustainable income streams.

Let’s consider a few tips for achieving financial prosperity.

How to Achieve Financial Prosperity: 5 Tips

1. Financial Literacy

Understanding makes you outstanding. You are more likely to excel in areas where you are knowledgeable. Your level of knowledge in an area or topic greatly determines if you will be a success or a failure. Therefore, it’s important to have financial literacy. Financial literacy is the process of gaining knowledge and insight into the acquisition and management of money.

It involves building a culture of savings, budgeting, investing, problem-solving, and deepening your overall financial skills and personal financial management. Not everyone is skilled with money or its use.

Financial literacy empowers you to turn a little into plenty and sustain that increase for as long as it takes. It might be costly in terms of time, humility, spending money to buy books, and listening to resource persons on finance, but it is worth it.

The more you LEARN, the more you Increase your capacity to EARN!

2. Embrace an entrepreneurial mindset

The concept of earning a salary revolves around the idea of receiving a reward for one’s work at an appointed time. On the other hand, an entrepreneur is someone with a business mindset who focuses on problem-solving, meeting people’s needs, and making money by serving others.

Pastor Matthew Ashimolowo describes entrepreneurs as individuals who create and operate businesses. In the realm of financial prosperity, individuals fall into four categories: employees, self-employed individuals, business owners, and investors. Employees receive paychecks for their services at set intervals, while self-employed individuals work for themselves, often without needing to be physically present to make money.

To achieve financial prosperity, it is ideal to aim to become a business owner or an investor. In these roles, one can earn money without being physically present and can expand their reach by having multiple locations and investments.

It’s also important to diversify one’s portfolio and spread their financial risk. Entrepreneurs are known for being problem solvers, and there is a high demand for individuals who can provide solutions.

In Nigeria, there is a greater need for creators of solutions rather than just consumers of solutions. Therefore, it’s essential to position oneself as someone who solves problems, meets the needs of others, and prospers financially through these endeavours.

While receiving a paycheck is fine for those who are employed, it’s important to save and invest to become a problem solver and achieve financial prosperity. Ultimately, the goal should be to transition from being an employee to becoming a problem solver.

3. Practice financial discipline and budgeting

It is essential to maintain control over your finances through disciplined budgeting and smart spending to achieve financial prosperity. For individuals, this involves tracking income, and expenses, and saving regularly.

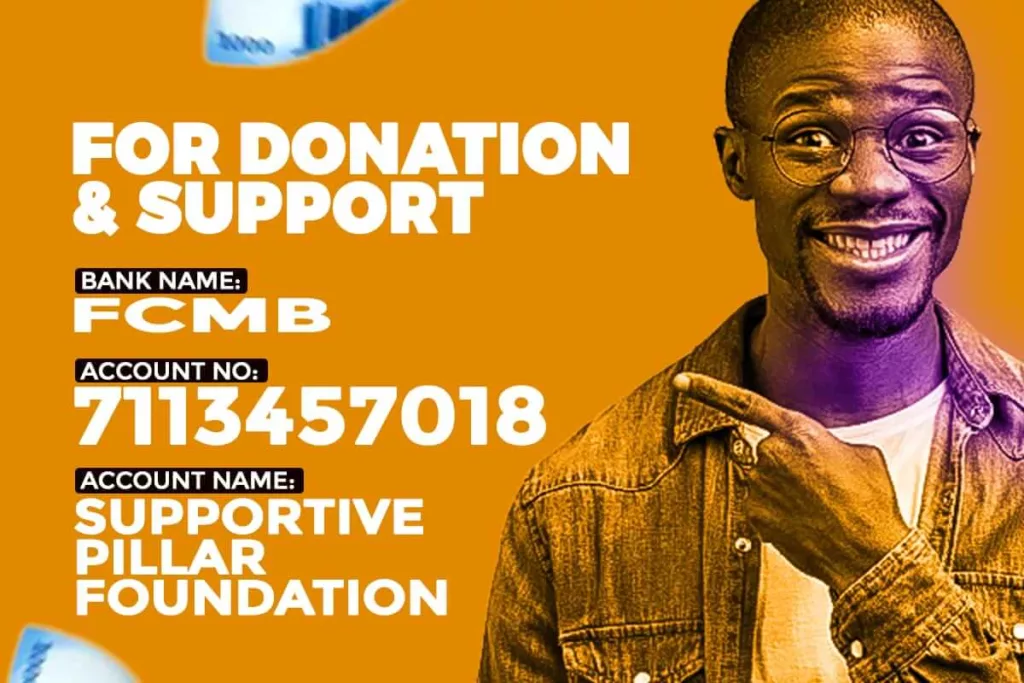

For the Supportive Pillar Foundation, effective financial planning ensures efficient utilization of donations and resources, maximizing the organization’s ability to help the less privileged, while also setting aside funds for future projects and emergencies.

4. Invest in Long-Term Growth

Instead of solely concentrating on short-term financial goals, it’s important to prioritize investments that promote long-term growth. This can include investing in education, regular honing of skills, or capital investments.

For individuals, this may involve investing in stocks, real estate, or personal growth. For the Supportive Pillar Foundation, it could mean providing funding for community programs that empower individuals with skills and resources to break the cycle of poverty, thereby ensuring a lasting positive impact.

5. Diversify Income Streams

In order to attain genuine financial prosperity, it is crucial to move beyond depending on just one paycheck. Explore various income streams, such as investments, side businesses, or online passive income sources. These can help you steadily build wealth and reduce financial vulnerability.

For organizations like the Supportive Pillar Foundation, diversifying funding sources through grants, partnerships, or social enterprises can ensure long-term sustainability and expand the impact on the less privileged.

Conclusion: How does the Supportive Pillar Foundation change the financial future of those who are less privileged?

The pursuit of financial stability is crucial for a charity organization like the Supportive Pillar Foundation. With our core values always in mind, we consistently strive to assist the less privileged in society through intensive annual free training and empowerment, quarterly support schemes for widows, and more.

Achieving financial prosperity allows us to expand our impact, reach more vulnerable communities in Nigeria and beyond, and provide sustainable solutions for free. Financial prosperity enables the Supportive Pillar Foundation to not only cover its operational costs but also invest in long-term initiatives that uplift the lives of those in need, ensuring a brighter future for many.

To be continued…

The Supportive Pillar Foundation in Nigeria combats hunger and empowers the underprivileged.