ECONOMY

The dual problem of poverty and the scourge of unemployment drives many youths to grab entrepreneurship via participation within the Micro, Small, and Medium Scale enterprises, which have failed to elevate people out of poverty.

As Nigerians get set for any other season of political campaigns in preparation for next year’s elections, economic analysts expected that as standard, prospective public workplace seekers might construct conversations on economic prosperity around Micro, Small, and Medium organizations (MSMEs).

This is because, other than contributing to the state’s export earnings and Gross domestic Product (GDP), MSMEs have been validated to be a primary task issuer for the teeming youths.

According to the Chairman, of Proshare Nigeria, confined Mr Olufemi Awoyemi, MSMEs, in any other case truly called small businesses can be defined as the engine of growth in many economies.

Drawing inspiration from the paintings of a famous American creator and founder of Michael E. Gerber Groups, a business skills training corporation, Michael Gerber, Awoyemi listed 10 motives that usually cause the fall apart of small businesses to encompass loss of management systems; loss of imagination and prescient, motive, or concepts; lack of monetary planning and review; over-dependence on particular individuals inside the business and terrible marketplace segmentation and/or strategy.

Others are failing to establish and/or say their company goals; opposition or loss of marketplace knowledge; inadequate capitalization; absence of a standard-first-class program; and proprietors concentrating on the technical, rather than the strategic, work to hand. All of the ten elements are quite glaring among Nigeria’s small corporations.

Why Nigerian Small Businesses Fail

However, from the studies of small-scale enterprise promoters in Nigeria, commercial enterprise failure is major as a major result of a lack of admission to adequate financing, bad/poor and almost non-existent infrastructure, high taxation, and unreliable/irregular policies of the government, among others.

According to Mr Peter Oyolola, a supervisor with a small-scale fish farm in Akoko, Ondo state, most of the initial profits that can be ploughed back into the enterprise are being diverted to different uses, including the provision of basic infrastructure like generation. He added that he spends an average of N20,000 weekly to power his two generators, which he uses to run his pumping machines. He lamented that banks are not ready to help small-scale commercial enterprise operators like him whilst all his efforts to benefit from the Central Bank of Nigeria’s assistance didn’t yield any positive result.

Every other problem that came up turned into constant harassment by nearby government officials. “We pay all manners of the levy but we don’t enjoy anything”. We find it difficult to convey our products to the market because cars are avoiding some bad roads. In the end, the Ondo state government abandoned us.

It reviews that bad roads and unstable strength supply are not unusual denominators across the numerous states, a development which has persisted to shape small agencies to close shops.

Awoyemi explained: “Since small businesses are too vulnerable to provide an alternative power supply/source, the epileptic power supply in Nigeria has decreased capability utilization, which causes damage to equipment and causes the demise of many small businesses. Generally, Nigeria is well known as a high-cost origin and this explains why Nigeria isn’t doing well in the export marketplace – be it of goods or services.”

Lack of sense of economic Liberty

But, despite all of the myths woven around small and medium-scale businesses, analysts are starting to dismantle the vintage narratives that presented small-scale monetary tasks because of the top-quality solution to poverty and adolescent unemployment.

The concept that the continuous encouragement of Micro, Small, and Medium Scale establishments (MSMEs), is a sure wager technique to economic development is false, foolish, unscientific, fraudulent, wasteful, mediocre, lazy, and deleterious to our effort at accomplishing monetary improvement.

The strategy of relying on SMEs to raise and rework Sub-Sahara African economies is a very much failed one already. Our SMEs can’t do better than promote imported items. Nearly all have neither the endurance, perseverance, time, assets, finance, personnel, structure, and certainly suggestion, to be innovative in a way that could inch black Africa in the direction of relative self-sufficiency, or even help in fixing our existential hassle.

And all and sundry who keep pushing that approach have to keep in mind that we are merely markets for overseas importers from China and Western international locations by selling MSMEs.

It’s hoped that authorities or the government will discover an escape path to salvage the MSMEs as a way of addressing the problem of unemployment and the attendant surge in the crime rate in Nigeria.

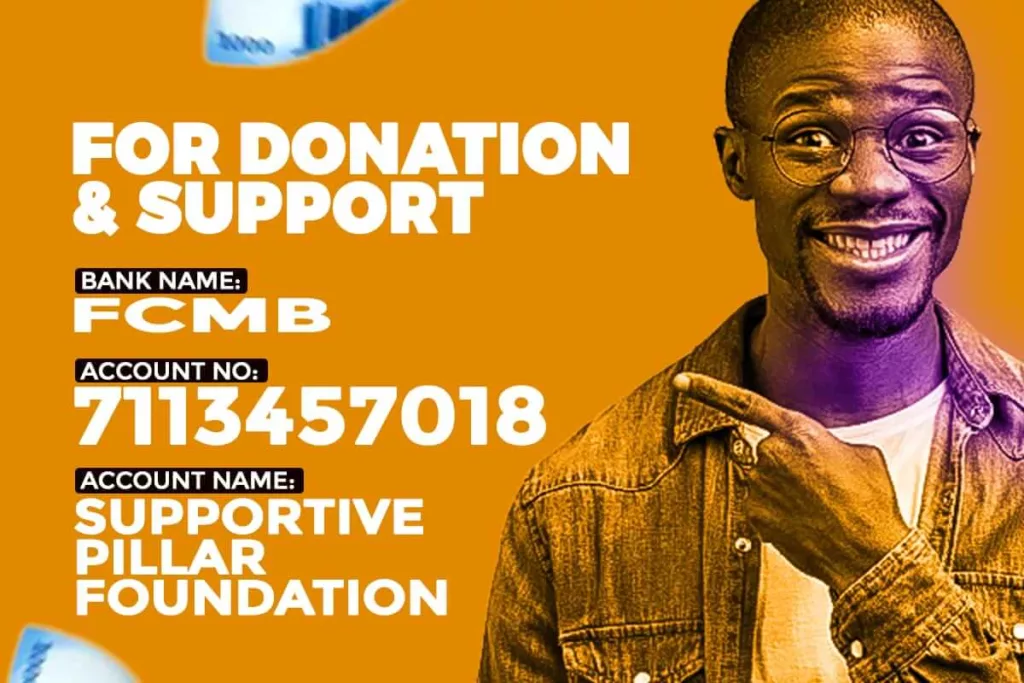

The Supportive Pillar Foundation in Nigeria combats hunger and empowers the underprivileged.